tax return remittance voucher

These forms are available only in paper format due to. Edited 22117 You can get a copy of your federal state tax return and all of their accompanying forms worksheets payment vouchers etc by following the directions below.

/1040-V-df038816cc244b248641f447493a030d.jpg) |

| Form 1040 V Payment Voucher Definition |

Your social security number SSN.

. Your social security number SSN if a joint return SSN shown first on your return 2. Nonresidents should file Form NJ-1040NR and write the word Amended in bold letters in the upper right hand corner. Nonresident Income Tax Return Instructions. Amending a Nonresident Return.

The payment voucher at the bottom of Form 1040-V should be detached and mailed with your tax return and payment. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government. Form RC159 Remittance Voucher Amount Owing. Employer identification number EIN.

Do not staple or attach this voucher to your payment or return. Log in to e-Services. Generally tax returns and return information are confidential as required by section. Use form FTB 3582 Payment Voucher for Individual e-filed Returns only if both of the following apply.

Department of the Treasury Internal Revenue Service 99 Payment Voucher. Save the PDF fillablesavable form in a folder that you will easily find on your computer. If you are receiving a refund or low tax due and Turbo Tax prepared the vouchers then your tax liability was probably reduced by credits. Use the e-Services Payment System Some tax software lets you make or schedule payments when you file.

He sent a check for 1500 with his original return reflecting a payment of 1400 in taxes and a 100 estimated tax penalty. Detach Here and Mail With Your Payment and Return Form. CRA PIT Amount Owing Remittance Voucher. 11 rows Payment Vouchers.

Your Social Security. They might have printed out if you got a one time large income this year like if you took a IRA or 401k distribution. Department of the Treasury Internal Revenue Service 99 Payment Voucher. Do not staple or attach this voucher to your payment or return.

These vouchers should only be used when sending in a tax return. Dont staple or attach this voucher to your payment or return. You must bring a personalized remittance voucher so that the payment can be properly applied to your tax account by the CRA. Form RC160 Remittance Voucher Interim Payments.

For your GSTHST payroll and corporation remittance vouchers. You filed your tax return electronically. Arizona Transaction Privilege Tax Efile Return Payment Voucher. Form RC158 Remittance Voucher Payment on Filing.

Every remittance voucher has an Account number box for the CRA business number BN. Nonresident Income Tax Return. If you do not have a remittance voucher. If you use a non-personalized remittance voucher enter the full 15 digits of your CRA business number.

It appears that the proper Payee to choose for your 2016 personal income tax return is CRA PIT 2016 Tax Return Remittance. Note that you do not need a remittance voucher when making your payment electronically. You have a balance due and pay with a check or money order. Department of the Treasury Internal Revenue Service 99.

File Now with TurboTax. Although the IRS will gladly accept your payment without the 1040-V including it enables the IRS to process your payment more efficiently. Detach Here and Mail With Your Payment and Return Form. When completing Form 1040-X Dillon enters 1400 on line 16 the check sent with the original return minus the 100 penalty.

Complete or mail the voucher below. If you owe tax choose one of the following payment options. The voucher asks for four main pieces of information. To cancel a payment made through tax software you must contact us.

Estimated Tax Voucher is an optional IRS form that you include with your check or money order when you mail your tax payment. This form is for income earned in tax year 2021 with tax returns due in April 2022. They are used specifically for paying the CRA at financial institutions Canada Post retail outlets or by mail. We have four common personalized remittance vouchers that we may send with your statements or notices.

To be able to fill in and save a PDF form download and then open the form using the free Adobe Reader. Arizona Marijuana Excise Tax Return Efile Return Payment Voucher. Have a balance due do not. USE THIS OPTION TO MAKE A CRA PERSONAL INCOME TAX PAYMENT FOR SUBSEQUENT 2016 PAYMENTS AFTER FILING YOUR RETURN AND PAST TAX OWED FOR.

Use your social insurance number as your account number. Paying with Debit and Credit Cards. The CRA accepts payments made with Interac debit cards through the My Payment. For payment options and information.

Submit this statement with your check or money order for any balance due on the Amount you owe line. AR1000-V Individual Income Tax Payment Voucher. Small Business Income Forms. Remittance voucher - business tax payments.

Make your check or money order payable to United States Treasury. You can obtain a payment voucher 1040-V to print and send in with your payment by. Income Tax Payment Vouchers. Detach Here and Mail With Your Payment and Return Form.

Filling and saving PDF forms. If you receive a billing notice use the voucher that is attached to that notice or call our office. Below are the vouchers to remit your Sales Use and Withholding tax payments. Form RC177 Remittance Voucher Balance Due.

CRA revenue-tax instalments. Browse to the folder where you saved the file and open it from within Adobe Reader. We last updated Federal Form 1040-V in January 2022 from the Federal Internal Revenue Service. Simply put a remittance voucher is an important piece of paper that provides the CRA Canada Revenue Agency with the necessary information about your tax payments.

2021 Payment Voucher. This will ensure that you get credit for the payment. Payment Voucher not to be confused with 1040-ES. Nonresident - Extension Estimated Payments and Payment Vouchers.

Call 651-556-3000 or 1-800-657-3666 toll-free at least three business days before the scheduled payment date. You can order personalized remittance vouchers and in some cases print your own. Arizona Individual Income Tax payment Voucher for Electronic Filing This form has no separate instructions Payment Vouchers. Information about Form 1040-V Payment Voucher including recent updates related forms and instructions on how to file.

Financial institutions do not accept photocopies of remittance vouchers or any other type of payment form.

|

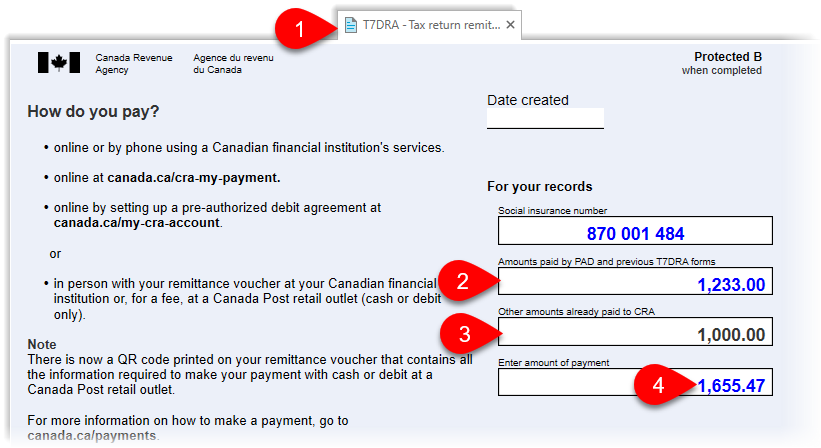

| T7dra Remittance Form Taxcycle |

|

| Salary Slip Template 5 Payroll Template Job Letter Resume Template Free |

|

| T7dra Remittance Form Taxcycle |

|

| Lumina Homes Affordable House In The Philippines Luminahomes Houseforsale Luminahomespagadiancity Affordable Housing Lots For Sale Philippines |

|

| After Sending Us Your Tax Return Learn About Your Taxes Canada Ca |

Post a Comment for "tax return remittance voucher"